What is an MDD?

An MDD is a short summary of a unit trust, which is published monthly or quarterly by the manager of the unit trust. The information on the document shows a snapshot of the fund’s performance, as well as the factors which were responsible for returns; like the risk taken and the investments made by the fund. The MDD will also show information concerning how the fund operates, including any regulations it is subject to, fees and information regarding the investment manager and management company. Below we look at a few of the important information you will find in an MDD.

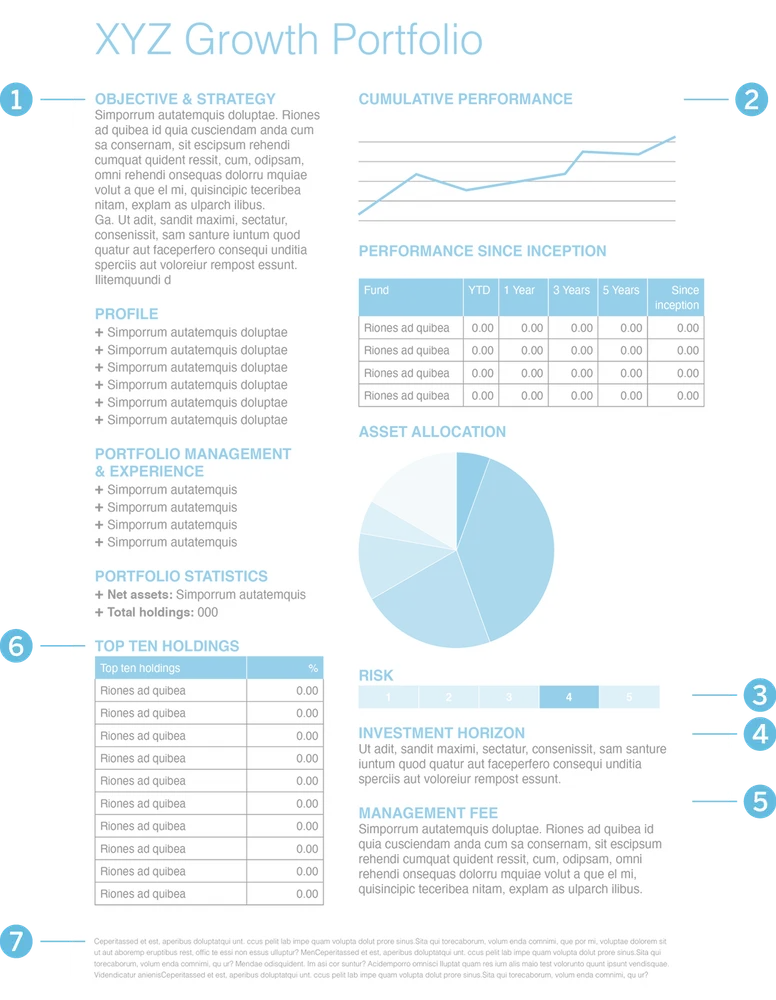

1 Returns

Performance or ‘returns’ show how the fund has performed over a given period. The total returns seen on an MDD include the capital growth, as well as show any income earned by the fund. The performance is typically displayed using a returns table, showing performance over multiple time periods: e.g. one year, three years, etc., where performance is annualized for periods longer than one year. Performance can also be displayed in a graph or table showing the historic monthly returns. With these historical returns, an investor can see how the fund has performed over time, against its selected benchmark and possibly how it compares to its peer group. Although historic returns can never be used as a guarantee for future returns, it is helpful to understand how the fund has performed during different market cycles.

2 Underlying Exposure

The exposures or underlying investments made by the fund are reported on an MDD. An MDD can show a number of graphs and tables that help an investor understand what the fund is invested in, as this will impact the returns of the fund. Multi-asset funds will show a breakdown of the exposure in each asset class. Some MDDs show asset class specific details. For example, equity funds may show geographic or sector specific exposure. Often, mangers will report on the top ten instruments the fund is invested in. Fund of funds and multi-managed funds also show the underlying unit trusts they are invested in. All of these metrics give the investor insight into how the manager invests on behalf of the fund, as well as what is responsible for the fund’s performance.

3 Investment horizon

The stated investment horizon is the minimum recommended term an investor should stay invested for, given the fund’s objective.

4 Goals and objectives

Each MDD will state the fund’s investment objective, as well as the metrics used to determine whether the fund is meeting that objective. This is known as a benchmark and/or target.

5 Risk

Typically, the lower the risk, the lower the potential return, and conversely the higher the risk, the higher the potential return. That said, there is no guarantee that returns will be higher when investing in a portfolio with a higher risk profile. Investors can easily see what level of risk fund they are investing in on the MDD by looking at the table of risk statistics.

Note: Risk profiles are a mere guide based on the holdings/exposures of each fund and what it is designed to achieve. It is important to note that the risk profile is typically a subjective categorization. In addition, the risk profile does not take the impact of exchange rate fluctuations into account that are associated with offshore feeder funds.

6 Fees

Fees are always shown on an MDD. The Total Investment Charge (TIC) is the expense the fund incurred over the calculation period, expressed as a percentage of the fund value and annualised. The TIC is made up of the Total Expense Ratio (TER) and the Transaction Costs (TC). A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. If a performance fee is applicable to the fund, it will be disclosed in the MDD.

7 Disclaimers and Restriction

Often found near the end of an MDD are the disclaimers, which disclose what regulations the fund is subject to and more specific details on how the fund operates. Regulations include the maximum and minimum allocation a fund is allowed to have exposure to in different asset classes or types of investments.